san mateo county tax collector property tax

Property Tax Programs external website. The Property Tax Division manages key aspects of the property tax process including that property taxes payable by each taxpayer are accurately calculated taxes collected are accurately distributed to taxing agencies and that any tax refunds due are processed in a timely manner.

Secured Property Taxes Tax Collector

County of San Mateos Treasurer-Tax Collector offers a Secured Property Tax Search where you can find your property tax by searching by address or parcel number.

. Small business owners may be exempt from personal property tax assessment in San Mateo County if their personal property is valued at 5000 or less. 1206 31ST AVE SAN MATEO. There is no charge for filing for the Homeowner Exemption.

San Mateo County has one of the highest median property taxes in the United States and is ranked 45th of the 3143. You can also make a payment or get more information and assistance by calling us at 650 363-4155 and speaking to a Revenue Services staff member. 115 INDEPENDENCE DR MENLO PARK.

County of San Mateos Treasurer-Tax Collector offers a Secured Property Tax Search where you can find your property tax by searching by address or parcel number. Some San Mateo County property owners whose properties were in the Decline in Value Assessment Program may see an increase restoring to factored base year value in their assessment values by more than two percent 2. Pay Transient Occupancy Tax.

You also may pay your taxes online by ECheck or Credit Card. Making a payment can be as easy as making a telephone call. 9 AM - 5 PM.

San Mateo County collects on average 056 of a propertys assessed fair market value as property tax. Sandie Arnott San Mateo County Tax Collector. Assessed Valuation by Account.

Redwood City CA 94063. The 1st installment is due and payable on November 1. San Mateo County secured property tax bill is payable in two installments.

Search and Pay Property Tax. Of December 10th to make your payment before a 10 penalty is added to your. Summary of Valuations of Property in the Assessment Rolls of the County.

FEDCANPDES STORM FEE 650 363-4100. The median property tax in San Mateo County California is 4424 per year for a home worth the median value of 784800. 2021 Secured Annual Bill 2021-293019.

However they are still required to file a statement if requested by the Assessor. The median property tax on a 78480000 house is 580752 in California. Contact Us Treasurer-Tax Collector Home.

Pay Transient Occupancy Tax. Sandie Arnott San Mateo County Tax Collector. With approximately 237000 assessments each year the Assessor Division creates the official record of taxable property local assessment roll shares it with the County Controller and Tax Collector and makes it publicly available.

SMC MOSQ ABATEMNT ASSMNT. 555 County Center - 1st Floor. Open San Mateo County.

Ad Get In-Depth Property Reports Info You May Not Find On Other Sites. NSMCSD SEWER FEE 650 991-8084. Office of the Assessor.

Redwood City CA 94063. The law provides property tax relief to property owners if the value of their property falls below its assessed value. 555 County Center - 1st Floor.

The median property tax on a 78480000 house is 824040 in the United States. Account 039-232-210 1206 31ST AVE. Phone Hours are 9 AM - 5 PM Monday - Friday Excluding all Holidays.

The Tax Rates and Valuation of Taxable Property of San Mateo County publication includes. For information on other programs such as those for veterans or for disaster relief please visit the San Mateo County Assessors website. Homeowners Property Tax Exemptions.

If you own a home and occupy it as your principal place of residence on January 1 you may apply for an exemption of 7000 from the homes assessed value which reduces your property tax bill. Search and Pay Business License. Access to Market Value Tax Info Owners Mortgage Liens Even More Property Records.

Just call 1-877-496-0510 and use our interactive voice response system. 9 AM - 5 PM. However you have until 500 pm.

The Assessor is responsible for determining the assessed value of all taxable property located in San Mateo County. For more information call 6503634501. Make Tax Checks Payable to.

This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in San Mateo County. Court A- Dong 650. Contact Property Tax Accounting Staff if you have questions relating to refunds.

Search and Pay Property Tax. Make Tax Checks Payable to. Announcements footer toggle 2019 2022 Grant Street Group.

Phone Hours are 9 AM - 5 PM Monday - Friday Excluding all Holidays. Account 055-236-190 115 INDEPENDENCE DR. Levying authority Phone Number Amount.

You can then pay by credit card right over the phone. In fulfilling these services the Division assures that the County complies with necessary legal. 2019 2022 Grant Street Group.

San Mateo County Tax Collector at 555 County Center 1 Redwood City CA 94063. New property owners will automatically receive an exemption application in the mail. City Of San Mateo Bond.

Quickly find Treasurer Tax Collector phone number directions services San Bruno CA.

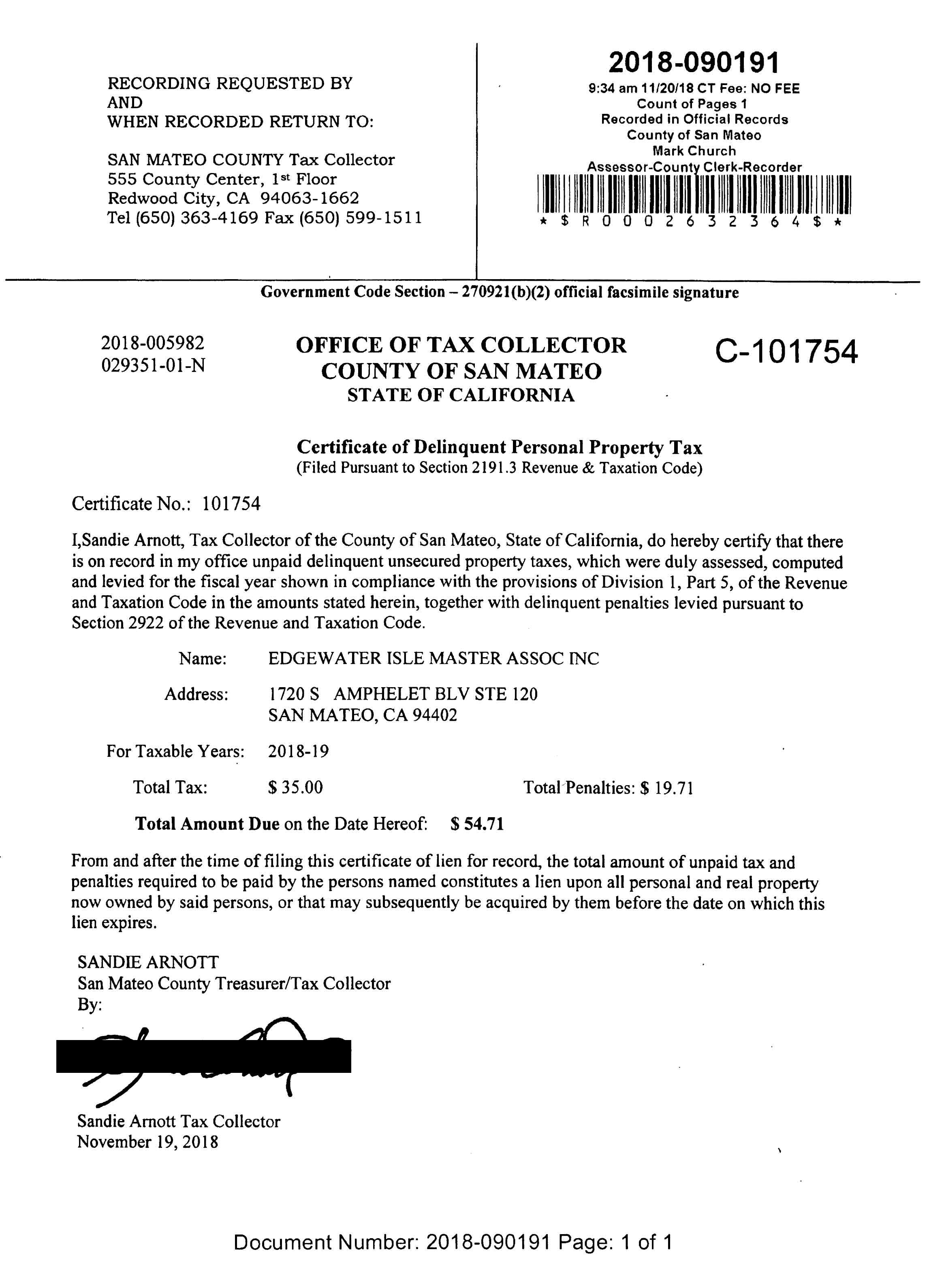

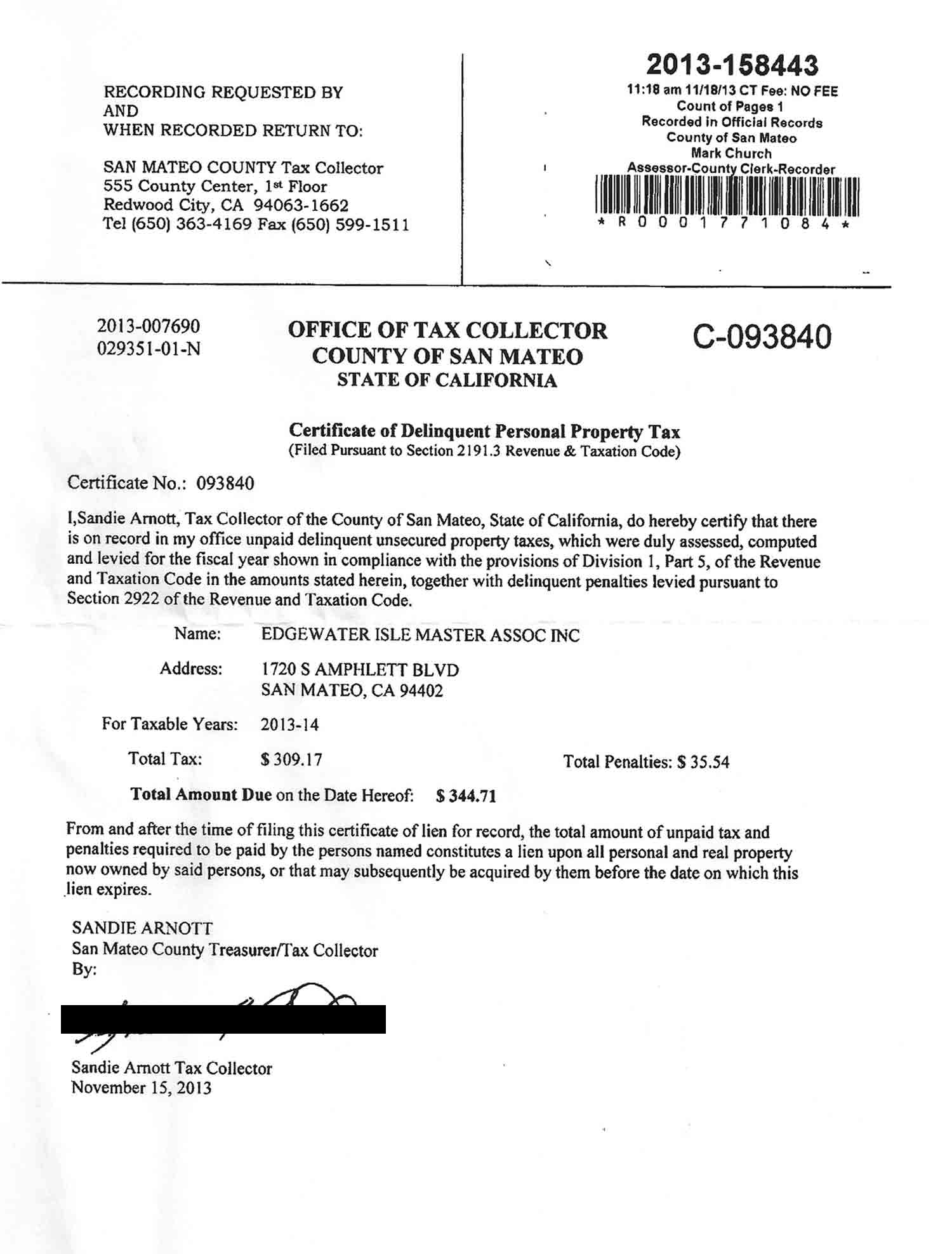

San Mateo County Issues Liens Against Master Association

Sandie Arnott For Treasurer Tax Collector 2022 Facebook

Property Tax Search Taxsys San Mateo Treasurer Tax Collector

106 W 3rd Ave Apt 2 San Mateo Ca 94402 Realtor Com

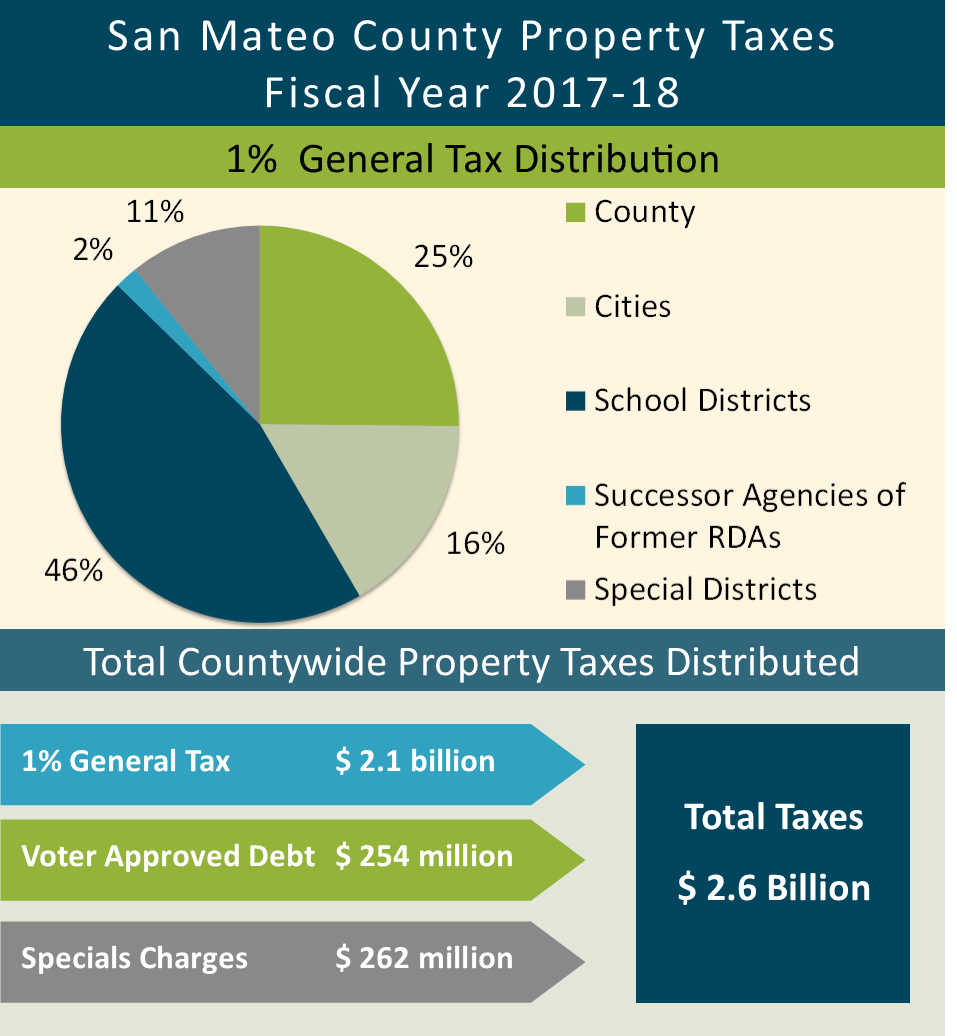

Controller Releases Property Tax Highlights Showing Seventh Year Of Growth Everything South City

Secured Property Taxes Tax Collector

San Mateo County Ca Property Tax Search And Records Propertyshark

County Of San Mateo Government Quick Tip Tuesday Some Santa Clara County Taxpayers Reported Receiving Bogus Letters Like The One Pictured In This Post From A Non Existent Tax Lien Office

San Mateo County Ca Property Tax Search And Records Propertyshark

County Of San Mateo Government Quick Tip Tuesday It S That Time Of Year Again Secured Property Taxes Are Due By 5 P M On Dec 10 Payments May Be Made Online

San Mateo County Ca Property Tax Search And Records Propertyshark